The International Accounting Standards Board (‘Board’) has concluded comments period for Exposure Draft ED/2019/7 – General Presentation and Disclosures 9 (‘Exposure Draft’) on September 30, 2020 (deadline was extended from June 30, 2020 because of the Covid-19 pandemic).

The Board has come up with series of amendments primarily relating to IAS 1 – ‘Presentation of financial statements’ and correspondingly proposed limited amendments to other standards. We have summarised herewith the key amendments affecting entity’s financial statement preparation and disclosure process.

The Exposure Draft is part of Primary Financial Statements project, undertaken by the Board on better communication in Financial Reporting. It is targeted to respond to the strong demand from stakeholders to undertake a project on performance reporting.

Summary

- Structural changes for presenting financial performance of entity

- Introduction of three subtotals while presenting income statement

- New definition to propose for integral and non-integral associate and joint ventures

- Principles and general requirements on the aggregation and disaggregation of information presented in primary financial statements and disclosure in the notes

- Definition and disclosure for management performance measures

- Amendment In the statement of cashflow

Effect of the Exposure Draft

The Board expects the proposed changes in the Exposure Draft to affect all entities that apply IFRS Standards to prepare financial statements. However, the effect of these proposals will vary amongst entities.

Structural changes for presenting financial performance of entity

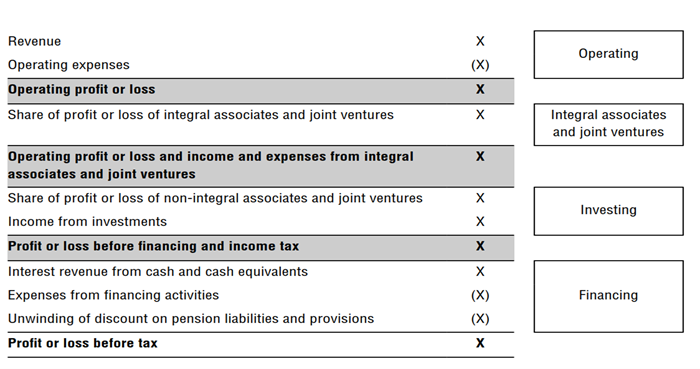

Table below is a summary income statement prepared by an entity applying changes proposed in the Exposure Draft with following assumptions:

- Entity does not make investments as its main business activities

- Entity is not into financing as its main business activities

Introduction of three subtotals while presenting income statement

The Exposure Draft proposes that an entity present the following new subtotals in the income statement (as shown in Table above)

- operating profit or loss;

- operating profit or loss and income and expenses from integral associates and joint ventures; and

- profit or loss before financing and income tax.

In applying these proposed new subtotals, an entity would present in the income statement classified in the following categories (these categories are shown in the boxes on the right in Table above):

- operating;

- integral associates and joint ventures;

- investing; and

- financing.

Introduction of disclosure of integral and non-integral Associates and Joint ventures in the financial statements

The exposure draft introduces the concept and definition for integral and non-integral Associates and Joint ventures. Further, based on the above identification / assessment, the entity shall disclose net profit or loss from these investments in the financial statements as below.

- If the net profit / loss emanates from non-integral Associates or Joint Ventures, the same shall be disclosed in the face of the income statement separately under the investing category as outlined in the table above.

- If the net profit / loss emanates from integral Associates or Joint Ventures, the same shall form part of operating profit / loss in the income statement.

The impact of this proposed change would affect the comparability amongst entities within the industry. Professional judgment is involved in deciding whether an associate or joint venture is integral and non-integral in nature.

Principles and general requirements on the aggregation and disaggregation of information presented in primary financial statements and disclosure in the notes

Under this section, the Board proposes:

- To disclose in single note an analysis of its total operating expenses using the nature of expense method when income statement is presented operating expenses using the function of expense method

- To introduce a definition of ‘unusual income and expenses’ and requires all entities to disclose unusual income and expenses in a single note

Definition and disclosure for management performance measures

The Board proposes to introduce definition of ‘management performance measures’ and require an entity to them in single note. The Exposure Draft also proposes to specify the information an entity would be required to disclose about management performance measures, including a reconciliation to most directly comparable total or subtotal specified by IFRS Standards.

It is pertinent to mention that, currently, the management is providing their view of the performance of the entity outside of the financial statements, for an example, in management discussion and analysis sections of public documents. This proposed amendment will bring enhanced disclosure requirements and reconciliation inside the financial statements. This would include communicating management’s view of an aspect of an entity’s financial performance accompanied by disclosures in a single note to enhance transparency.

Amendment in the statement of cashflow

The Board proposes to require an entity to use the operating profit or loss subtotal as the starting point for the indirect method of reporting cash flows from operating activities as against the profit / loss before tax as the starting point.

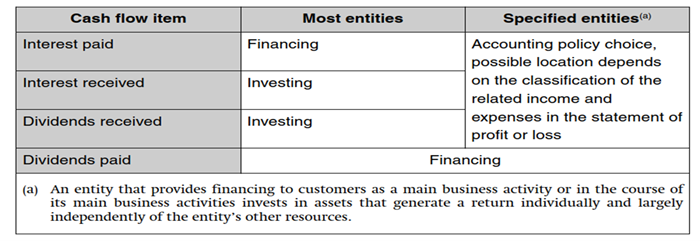

The Board also proposes to reduce the presentation alternatives currently permitted by IAS 7 requiring and entity to classify interest and dividend cash flows as shown in table below:

Classification of interest and dividend cashflow

Overall conclusion

Proposed changes in the Exposure Draft would lead to significant changes for entities in how they present or disclose financial information in the financial statement, in particular, in the income statement with proposed amendments to other standards:

- IAS 1 Presentation of financial statement

- IAS 7 Statement of Cash Flows;

- IFRS 12 Disclosure of Interests in Other Entities;

- IAS 33 Earnings per Share;

- IAS 34 Interim Financial Reporting;

- IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors to include some requirements from IAS 1;3 and

- IFRS 7 Financial Instruments: Disclosures to include some requirements from IAS 1.

References

You may refer full text of the Exposure Draft here. The Board has received 215 comments letters from different stake holders which can be accessed here. BDO has responded to this Exposure Draft which is available here.