Public Clarification and Amendment to Tax Procedures Law

16 November 2021

The Federal Tax Authority (FTA) has amended tax procedure provisions set out in Decree-law No. 7 of 2017 by the issue of Decree-law No. 28 of 2021. The amendment was issued on 16 September 2021 and is effective from 1 November 2021.

Summary

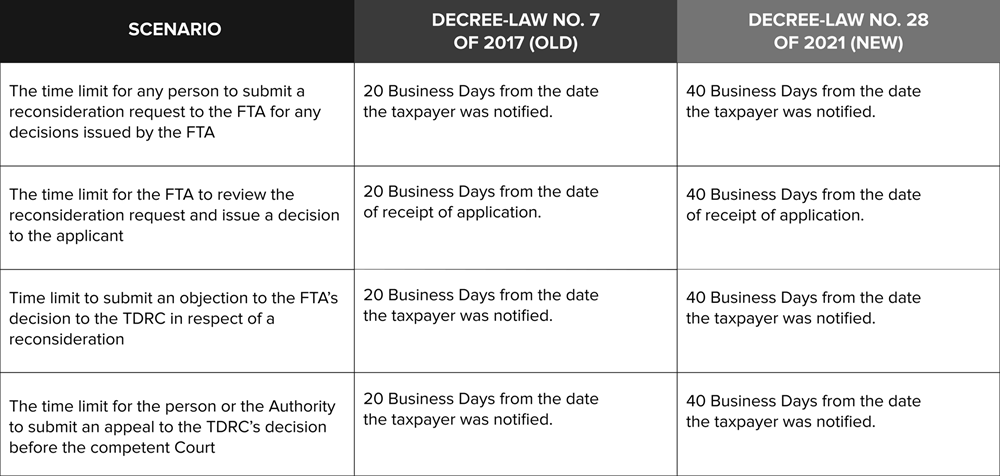

Decree-Law No. 28 of 2021 has extended timelines for:

- Taxpayers to request reconsideration of decisions issued by the FTA

- FTA to issue its decision regarding the disputed case

Decree-law 28 has also made amendments to the procedures for submitting objections and appeals. This includes removing or reducing the requirement to pay the disputed penalties as a prerequisite for access to the Tax Dispute Resolution Committee (TDRC) and Courts.

Timeframe extensions

Payment of Penalties

The amendment removes the requirement to pay penalties before filing an appeal to TDRC, provided the full amount of tax has been settled, and all other conditions for an appeal have been met.

Access to the courts will be allowed if partial payment (normally at least 50%) of the penalty has been made. This allowance is subject to meeting various conditions.

FTA has already released an alternative payment mechanism to settle the penalties where a taxpayer can provide an approved bank guarantee in favour of the FTA.

In addition, a new committee will be established that may approve the payment of penalties by instalments, waive or refund penalties. Requests to the FTA to waive penalties or pay penalties in instalments will only be processed once the Cabinet Decision stating the controls and procedures for the new committee is enacted.

Clarification link

Amended Executive Regulations link

If you would like to learn more about this topic or if you would like to discuss how BDO can help, please get in touch with your normal BDO contact or any of our VAT specialist team.