In our opinion effects of COVID-19 on respective entities to be considered on case to case bases. However, the effects of the COVID-19 outbreak are expected to have comparative less impact on impairment of financial and non-financial assets when entities are reporting on years ending on or before December 31, 2019. Consequently, forecasts, projections, and valuations for impairment calculations as at December 31, 2019 will need to be carefully reviewed to ensure that significant events related to the COVID-19 outbreak are not being incorporated in hindsight. However, if these estimates are expected to change significantly due to the factors brought on by COVID-19 after year end, additional disclosures should be considered.

In periods ended after the outbreak of COVID-19, the impact on future cash flow projections used in impairment testing will need to be considered.

Impairment testing requirement

As mentioned above all assets, except goodwill, intangible assets with indefinite useful lives and intangible assets not yet available for use, are tested in case if impairment indicators exist at the reporting date. COVID-19 will trigger many of the indicators of impairment noted in IAS 36.12(a)-(h) such as decline in quoted asset values, operational disruptions to supply chains, and decreases in revenue and profitability. Hence, testing of these assets for impairment will become more pervasive

Impact of COVID-19 on entities reporting interim results

Entities that prepare interim financial statements may need to prepare impairment calculations on assets within the scope of IAS 36 more regularly. For multiple reporting dates as impairment, indicators may exist at multiple dates despite minimum requirement (i.e. annual test) having already been carried out earlier.

Impact of COVID-19 on discount rate

In general, the discount rates should not reflect the risk of cash flow. However, an appropriate discount rate in a VIU calculation with multiple scenarios may still increase discount rate compared to previous impairment calculations, as market investors may require higher returns to accept risks in those various scenarios that are not wholly entity-specific (e.g. risks related to a particular industry sector).

Impact of COVID-19 on best estimate cashflow projection vs multiple scenarios in a DCF model

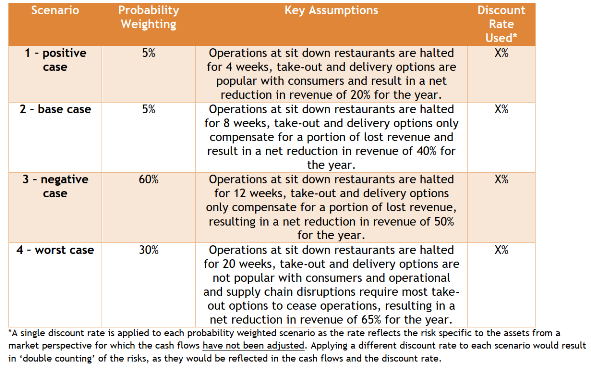

Additionally, entities may have previously used a single, best estimate cash flow projection in their DCF models. Such an approach may have been appropriate when the variability in future cash flows was low, or the risks inherent in the cash flows could be appropriately captured in the discount rate used. Given the high level of uncertainty that COVID-19 creates, entities may be required to consider multiple scenarios in a DCF model, each of which are probability-weighted. The expected cash flow approach, which uses multiple, probability-weighted cash flow projection is permitted (IAS 36.A4-A14) and not a new approach as per under IAS 36.

For example, consider an entity that operates several restaurants, some of which are traditional ‘sit down’ dining, while others are primarily focused on delivery. Depending on the length of mandated cessation of operations by governments and the enduring caution of consumers to visit restaurants in the future, it will need to forecast multiple scenarios in its DCF models. An illustration of this follows:

IAS 36 – INTERACTION WITH IAS 34 AND IFRIC 10

For entities that prepare interim financial statements in accordance with IAS 34, several specific points should be noted. IAS 34, Interim Financial Reporting requires the same accounting policies to be applied in interim financial statements as annual financial statements, and the frequency of an entity’s reporting should not affect the measurement of results in either an annual or an interim financial statement. For example, impairment recorded relating to property, plant and equipment in an interim financial statement may be reversed in subsequent interim or annual financial statements, as IAS 36 permits such a reversal. However, there is an exception because IFRIC 10, Interim Financial Reporting and Impairment requires that no such reversal may occur for goodwill, as IAS 36 does not permit an impairment recorded against the value of goodwill to be reversed.

If indicators of impairment exist for CGUs that contain goodwill, then goodwill will need to be tested for impairment at an interim period reporting date, even if that does not align with the annual testing cycle for goodwill. IAS 36.9 requires an impairment test to be carried out at the end of any reporting period if there is any indication that an asset may be impaired. For a CGU that contains goodwill, any impairment is allocated first to goodwill and then pro-rata to other assets based on their carrying amounts.

Additionally, if goodwill should have been impaired in an interim financial statement (e.g. a half-year or quarterly financial statement) due to the above-noted interaction between IAS 34, IAS 36 and IFRIC 10, then this will affect the next annual financial statements. Said another way, if goodwill was impaired in an interim financial statement, but it should not have been impaired if the impairment test had been performed at the annual reporting end (e.g. if conditions had improved by the year-end period), that impairment should be carried in annual financial statement.