Why ICV is important to you

The In-Country Value programs within the Middle East region will significantly impact upon any sizable entity’s policy towards investment, procurement, talent development and structuring, whether that entity is directly involved in the energy sector. International and regional businesses will need to define cohesive strategies to remain sustainably competitive as implementing these strategies take time to develop effectively. In developing any regional strategy, a thorough understanding of ICV is critical. Here we give an overview of ICV in the Middle East region.

What is meant by ICV?

For the countries rich in natural resources to remain economically sustainable long-term, it is key to ensure the development of its local talent, diversification of its GDP through sourcing more goods and services locally and keeping critical parts of supply chains local for key strategic elements of the country. Simply put, it means engaging with local stakeholders to hire, buy and invest locally.

To achieve this, countries have either approached this by specific contractual terms or by an ICV program. In the Middle East, an ICV program has been introduced within Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

In an ICV program, a criterion is set to calculate an ICV score for a supplier and that score is used in making procurement decisions.

Staying competitive in an ICV region

In Oman, the Ministry of Energy and Minerals started its ICV journey in 2013 for the energy sector. In Qatar, the ICV program is led by Qatar Petroleum for Tawteen, starting in 2020, and covers several strategic sectors beyond energy such as fertilizers and metals. In Saudi Arabia, the In-Kingdom Total Value Add (IKTVA) program was introduced by Saudi Aramco in 2015. Within the UAE, the ICV program was introduced for suppliers of Abu Dhabi National Oil Company (ADNOC) at the beginning of 2018. Since 2019, the program has expanded to cover different governmental and semi-governmental entities including Aldar Properties, Abu Dhabi Department of Economic Development, Mubadala Investment Company and Abu Dhabi Ports under a Unified Certification Process.

Whilst the Middle East remains a key trading hub for Europe, Africa, and Asia, it is also a key market itself. With a growing population, it will remain a key market in the long term. The ICV program has only recently started, and yet we can see the development of the program extending across more governmental bodies and across sectors. Due to the considerations such as ownership and the extent, to which businesses buy locally impacting upon ICV scores, most businesses will need to take account of ICV in their strategic planning to remain competitive. The key areas to consider in developing a strategy are drawn out in the analysis of how the ICV score is calculated below.

Is an ICV certificate mandatory?

Whilst an ICV score is one of the considerations in assessing a tender, suppliers without an ICV score can still submit a tender, but the ICV score used will be nil. We need to recognize that ICV is a part of a long-term strategy and supports economic sustainability. A part of that journey will be experienced by suppliers too as they develop strategies, which create more value within the respective country. There is an expectation, that many suppliers will initially have a relatively low ICV score, but as those strategies to invest locally take effect, these ICV scores will improve over time.

How the ICV score is calculated

Whilst the objectives of ICV is aligned in the region, each of the four countries in the Middle East take a different approach to calculating the ICV score as set out below.

ICV Oman

In Oman, ICV is heavily promoted in the oil and gas industry and encompasses a set of seven elements, which are factored into the tender evaluation criteria, against which suppliers are evaluated. These seven elements are:

- Investments in fixed assets

- Omanisation in the workforce

- Training of Omanis

- Local sourcing of goods

- Local sourcing of subcontracted services

- Development of national suppliers

- Development of national training, education and research and development institutions

ICV Qatar

In Qatar, the ICV formula is based on a plan of how the supplier will spend within the country. The aggregate ICV is measured as the total value created in the country across specific components, divided by the value of the contract. The specific components are goods and services, workforce training, supplier development and investments in fixed assets. Within the context of supplier development this would include costs incurred to increase the performance, skills, and capabilities of local suppliers.

A = Goods and services

B = Workforce training

C = Supplier development

D = Investment in fixed assets

As a part of the tender the ICV Plan is submitted. Throughout the duration of the awarded contract, the ICV Plan Tracker is used. At the end of the contract, a Special Purpose Audit is performed by an independent firm of chartered accountants on the project specific financial statements together with an ICV Certificate issued by an approved ICV Certifier representing the contract’s achieved ICV score.

The calculation of the ICV score considers the spend by vendors used by the supplier and the ICV scores of those vendors, thus effectively encouraging investment in the local economy.

IKTVA Saudi Arabia

The baseline IKTVA is determined by completing an IKTVA survey to participate in the IKTVA program. Once a participant of the IKTVA program, suppliers build a 5-year IKTVA action plan to improve the IKTVA score reflecting the developmental approach in creating value within Saudi Arabia.

The Supplier IKTVA formula is as follows:

A = Localized goods and services

B = Compensation paid to Saudis

C = Training and development of Saudis

D = Supplier development

R = Local research and development

E = Total In-Kingdom Costs

X = Export Revenue Factor expressed as a percentage based upon export revenue divided by total revenue up to a maximum of 10%

ICV UAE

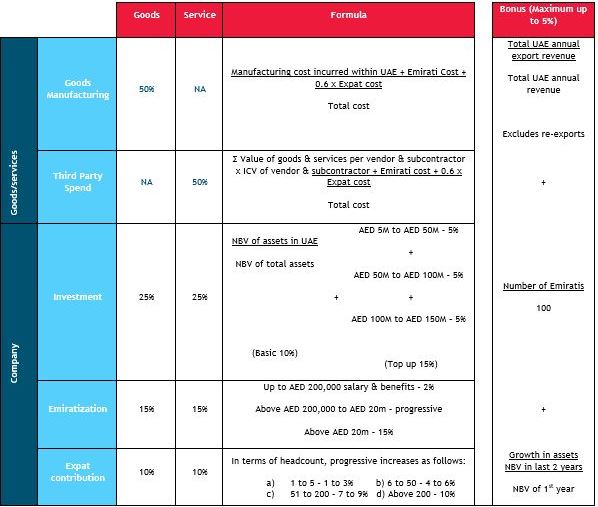

In the UAE, the ICV score is based to a large degree upon information extracted from the last set of audited financial statements as set out in the table below:

The ICV score is expressed as a percentage and is comprised of three broad elements, goods and services, the company, and a bonus factor. The calculation of the elements within the categories of the company and the bonus factor are reasonably straightforward.

It is the calculation of the goods and services element, which is interesting and leads to a change of how suppliers may choose vendors in the future and thus how vendors may position themselves to remain competitive.

Let us focus on where the supplier is a service provider (essentially any supplier that is not a goods manufacturer). There is a component which is the value of goods and services per vendor and subcontractor multiplied by the ICV of the vendor and subcontractor. The guidance gives ICV scores for various types of services, for example, landlords would be 80% for rent paid for the property.

Broadly the same principle is applied to calculating the manufactured cost incurred within the UAE for goods manufacturers, but here internal costs (amortization and depreciation) incurred within the UAE are also included. Considering that the ICV certification is valid for 14 months from the date of issuance of last audited financial statements, it is certainly worthwhile investing in mapping the accounts codes in the trial balance to draw out these elements used for the ICV to make this process more efficient and reduce the risk of error.

Some awards for tender may include an ICV improvement plan. These set out milestones to be achieved over the duration of the contract and the payment of the contract is linked in part to the actual achievement against the milestones of the ICV improvement plan.

How do I get an ICV certificate?

There is high quality information available from the respective bodies in each country to encourage participation and start the journey of increasing ICV over time. The respective bodies are set out above. In the case of Saudi Arabia, Qatar and Oman, the process starts with submitting either a ICV plan or survey depending upon the country. It is worth involving an approved ICV certifier at this initial stage as these submissions will form the basis of what will be certified in the future. For the UAE, one of the ICV empaneled certifying bodies will issue the ICV certificate. The information to determine the ICV score is drawn from the last set of audited financial statements. These financial statements should be no more than two years old at the time of submission.

Regardless of the country for which the ICV score is sought, it is worth ensuring that the financial statements are audited promptly after year end as these financial statements feature consistently as a reference point.

Final thoughts

It is important to note that ICV is evolving and will continue to evolve. The ICV in the UAE is in its third version. Interesting to note that whilst it does not impact upon the ICV score, the CSR activities of suppliers within the UAE are captured in the ICV documentation and there are clear definitions of the corporate structure of suppliers. This sets the landscape that the essence of doing business in the Middle East region is more of a long-term relationship that benefits all stakeholders. It is also tempting to look at the ICV score in absolute terms as they stand today, but really this is a journey within a partnership between suppliers and the respective countries to improve the ICV score, enhancing the economic sustainability of the Middle East region.

Please subscribe to ensure you don’t miss new content that we post