IFRS 15 - Revenue from Contracts with Customers

Background

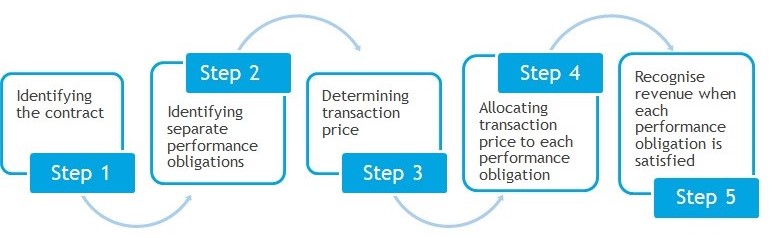

IFRS 15 brings a new and detailed approach to accounting for revenue, and is likely to have far reaching effects across a wide range of industries. It is based around a new ‘5 step’ model and contains a comprehensive set of requirements which are different from the current guidance in IFRS. Some of the differences are more obvious, while others arise from subtle changes in the detail that are not immediately apparent.

While IFRS 15 affects almost all entities in all industry sectors, the most significant changes to date have arisen at larger entities in the telecommunications, software, technology, real estate, pharmaceutical, construction and engineering, aerospace and defence, and automotive sectors. However, this is likely to be because those entities were aware that IFRS 15 would have a significant effect on them and have moved relatively quickly with their implementation projects. Entities in other sectors, and medium sized and smaller entities, are lagging and are running out of time. The adoption of IFRS 15 requires a detailed review to be carried out of all contracts that have been entered into.

The Five Step Model

Our IFRS 15 experts can help you determine the impact of the new standard on your reported earnings.

Questions which should be asked for adoption include:

Project management, Board sponsorship and communication with those charged with governance:

- What is the plan for transition?

- Which transitional approach and options are being adopted and why?

- What is the timeline?

- Who is responsible?

- What resources are available?

- What sponsorship does the project have at executive board level?

- How has the audit committee been briefed?

Detailed effects:

- What is the effect on the timing and profile of revenue recognition? (accelerate/defer, increase/decrease?

- How will changes in the timing and profile of revenue recognition affect bonus payments, share option plans, banking covenants and costs, and dividend policy?

- How will brokers and analysts react?

- Do current/future sales contracts need to be changed?

- Do current/future sales and marketing methods need to be changed?

- What changes are required to systems and processes?

- What are the staff training requirements (including sales and marketing staff, as well as finance staff)?

- How will sales, marketing, and finance departments need to liaise and communicate with each other in future?

What we can offer:

- Performing a detailed impact assessment of the adoption of IFRS 15.

- Providing assistance with the quantification of adjustments at the date of initial application and reporting date relating to recognition and measurement of revenue.

For more details and guidance on IFRS 9 application, please see IFRS Publications by BDO.