IFRS 16

Background

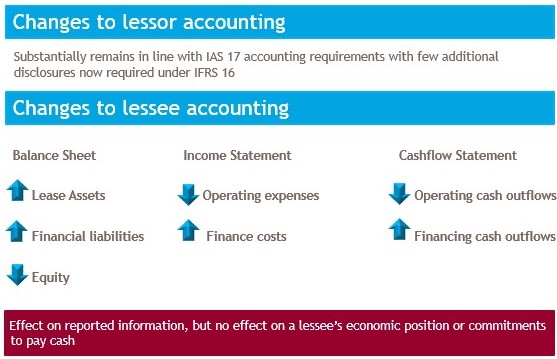

IFRS 16 Leases fundamentally changes the financial reporting landscape for how lessees account for operating leases. The new standard effectively removes the operating leases classification and requires all lessees to show a lease liability and a corresponding right-of-use asset for all leases (with some limited exceptions).

Entities need to ascertain what actions need to be taken so as to allow them to prepare their financial statements using this new accounting standard. The changes can be complex and have effects beyond just the accounting treatment.

As the choices made will affect the way the performance of the business is measured and reported, it is vital to consider not only the commercial and practical issues, but also the tax implications of these changes.

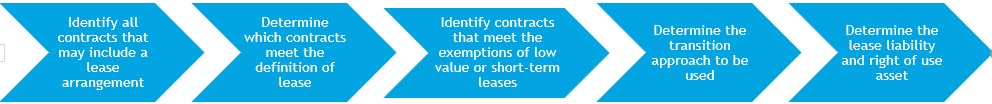

Steps to implementation

Our experts in this area can help you establish the impact of IFRS 16 implementation and advise on what actions you should be taking.

Questions which should be asked for adoption include:

Project management, Board sponsorship and communication with those charged with governance:

- What is the plan for transition?

- Which transitional approach and options are being adopted and why?

- What is the timeline?

- Who is responsible?

- What resources are available?

- What sponsorship does the project have at executive board level?

- How has the audit committee been briefed?

Detailed effects:

- Which leases will be brought on balance sheet?

- Which service contracts contain a lease?

- What will the effect be on borrowings and key ratios?

- If EBITDA or similar is a key performance indicator, or it is used as the basis for performance bonuses or share-based payments, what will the effect be?

- How will brokers and analysts react?

- What changes are required to systems and processes?

What we can offer:

- Performing a detailed impact assessment of the adoption of IFRS 16.

- Providing assistance with the quantification of adjustments at the date of initial application and reporting date relating to recognition and measurement of lease liabilities and right of use assets.

- Providing a lease management & IFRS 16 tool.

- Provide lease management services

For more details and guidance on IFRS 16 application, please see IFRS Publications by BDO.