The year 2020 has been an exceptionally challenging year so far due to the Outbreak of COVID-19. The effects of COVID-19 will require companies to adjust their systems that interact with financial reporting requirements. In this article, we have covered the financial guarantee contracts that are within the scope of IFRS 9 and their impact on financial reporting requirements due to COVID-19.

What are financial guarantee contracts?

IFRS 9 DEFINES A FINANCIAL GUARANTEE CONTRACT:

“As a contract that requires the issuer to make specified payments to reimburse the holder for a loss, it incurs because a specified debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument”.

The financial guarantees may have various legal forms (such as guarantees, letter of credits, credit default contracts or insurance contracts), and their accounting treatment does not depend on their legal form. Financial guarantee contracts that meet the definition of insurance contracts are outside the scope of IFRS 9 and accounted under IFRS 17 Insurance Contracts.

Accounting treatment of financial guarantees under IFRS 9

Financial guarantee contract is recognised as a financial liability at the time guarantor issues the guarantee. However, it is different from other financial liabilities in a way that subsequent measurement requirements for financial guarantee contracts are different from other financial liabilities recognised at amortised cost or fair value through profit or loss (FVTPL) under IFRS 9.

Initial Recognition:

Financial guarantee is recognised initially at fair value which is the amount of fee or premium received from an unrelated party to whom the guarantee is issued at arm’s length terms. Also for guarantees issued between parents and their subsidiaries, entities under common control, by a parent or subsidiary on behalf of a subsidiary or a parent no exemption exists from the measurement requirements of IFRS 9. Therefore, if an intergroup or intragroup financial guarantee is issued and no premium is received, the fair value will be determined using a different method that quantifies the economic benefit of the financial guarantee to the holder.

Subsequent measurement:

Subsequently, financial guarantee is measured at higher of the following:

- Expected Credit Loss (ECL) on financial guarantee in accordance with IFRS 9; and

- The amount initially recognised less any cumulative amount of income/amortisation recognised

How is the ECL impairment of a financial guarantee contract dealt with under IFRS 9?

A company should apply impairment requirements from the date the company become a party to the irrevocable commitment, which is also the date of initial recognition of financial guarantee.

Expected credit losses for a financial guarantee contract are the cash shortfalls adjusted by the risks that are specific to the cash flows.

Cash shortfalls are the difference between:

- The expected payments to reimburse the holder for a credit loss that it incurs; and

- Any amount that an entity expects to receive from the holder, the debtor or any other party.

IFRS 9 does not require a company to wait for the default event to occur in order to recognise the impairment. Instead, it requires the company to assess the changes in risk that the specified debtor will default on the contract.

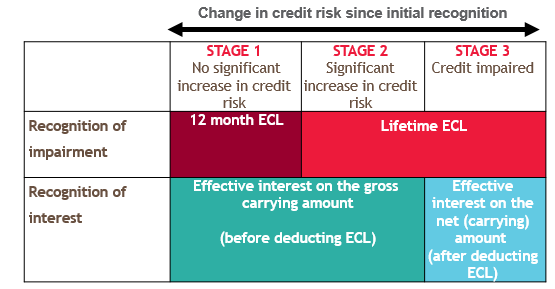

When the risk has not increased significantly, the amount of impairment shall be equal to 12-months expected credit losses. However, where the risk that the debtor will default on contract has been assessed to have increased significantly, the company is required to calculate impairment equal to lifetime expected credit losses. The period over which the expected credit losses shall be assessed is the maximum period over which the company has present obligation to extend credit.

Implications of COVID-19:

Calculation of ECL impairment is an integral part of the subsequent measurement of financial guarantees. IFRS 9 requires entities to measure ECL in a way that reflects reasonable and supportable information that is available without undue cost or effort at the reporting date about past events, current conditions and forecasts of future economic conditions.

The outbreak of COVID-19 has resulted in severe adverse economic conditions and higher risks of default which may result in increased amounts of ECL and may require financial guarantees to account at the amount of ECL instead of carrying amount.

COVID-19 impact on assessment of significant increase in credit risk (SICR) and ECL:

For financial guarantees, credit risk is assessed for the debtor instead of loan in respect of which the financial guarantee is issued. Therefore, the assessments based on staging and days past due on loan may not be relevant for assessing the increase in the credit risk of a financial guarantee. However, factors like change in external credit rating, changes in business or economic conditions in which debtor operates, changes in operating results, changes in regulatory requirements and such other factors as may be the relevant factors in determining the changes in credits risks of debtor.

Therefore, it requires careful consideration in assessing the SICR of debtor when calculating ECL impairment of a financial guarantee as follows:

- Risk of default occurring should be assessed over the expected life of the financial instrument and not based on short term impact of any uncertain events including COVID-19

- Intervention committed by government before the period end may affect whether there is a SICR

- It may be highly unlikely that historical data or past experience will be indicative of future losses as the breadth of COVID-19’s effects is unprecedented.

How can BDO help?

We have a dedicated IFRS advisory team that can assist in assessing the impact that COVID-19 may have on the business in terms of financial reporting and implementing the changes. For further information about how BDO can assist you and your organisation, please visit our IFRS Advisory page :

Click Here