By Brian Conn (Partner, BDO), Verona Hoh (Associate Director, BDO), Chris Williams (Managing Partner, Bracewell LLP Dubai), Ade Mosuro (Senior Associate, Bracewell LLP Dubai),

Watch webinar recording here:

On 30 April 2019, the UAE Cabinet, in response to the European Union's review of the UAE's tax framework and the UAE's commitment to the Organisation for Economic Cooperation and Development (OECD) anti-Base Erosion and Profit Shifting (BEPS) Action Plan, issued the Cabinet of Ministers Resolution No. 31 of 2019 concerning Economic Substance Regulations in the UAE (the "Regulations").

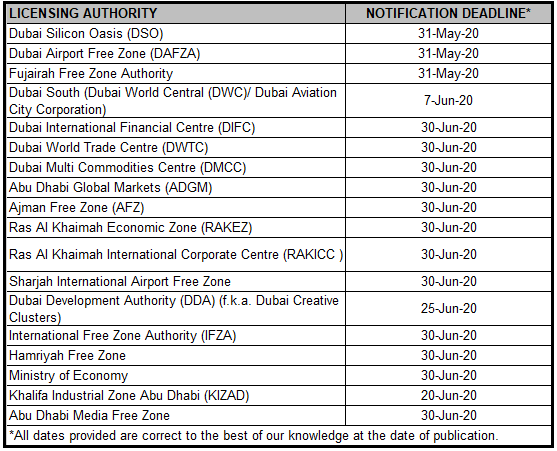

Following the issuance of the Regulations, the UAE Ministry of Finance (the “MOF”) issued a self-assessment notification template (the “Notification”), which all entities must complete and submit by the deadline set by its corresponding licensing authority (the “Licensing Authority”). Most Licensing Authorities have set a deadline of 30 June 2020, subject to the current exceptions set out below, including certain free zones where the date for submission has already passed.

Who must file a Notification?

All UAE entities (onshore, offshore or free zone) should notify whether they undertake any of the “Relevant Activities”. Relevant Activities include: (i) ‘Banking’; (ii) ‘Insurance’; (iii) ‘Investment Fund Management’; (iv) ‘Lease-Finance’; (v) ‘Headquarters’; (vi) ‘Shipping’; (vii) ‘Holding Company’; (viii) ‘Intellectual Property’; and (ix) ‘Distribution and Service Centres’.

The MOF have issued specific guidance on the meaning and scope of each Relevant Activity.

UAE entities that are directly or indirectly owned by the UAE government (both federal and local) are specifically excluded from the Regulations. On this basis, UAE sovereign investment funds and other UAE government controlled and/or related entities would not be required to meet the UAE economic substance requirements.

Importantly, the Regulations extend to not just entities incorporated in the UAE, but those “licensed” which would therefore include branches and representative offices as well as standalone subsidiaries.

The Regulations apply to financial years starting on or after 1 January 2019.

What are the economic substance requirements under the Regulations?

Where a UAE entity undertakes a Relevant Activity, such entity must meet the following economic substance requirements:

- the entity must conduct its core income generating activities (“CIGA”) in the UAE, i.e. it undertakes its key business activities in relation to its Relevant Activities in the UAE;

- the entity must be directed and managed in the UAE, i.e. holding board meetings and/or passing board resolutions on a periodic basis in the UAE; and

- the entity’s activities must be carried out with adequate local “economic substance” with regard to the level of relevant activity in the UAE. This includes demonstrating an:

- adequate number of full-time employees;

- adequate amount of operational expenditure; and

- adequate level of physical assets.

It is noteworthy that holding companies, whose main activity is restricted to solely possessing shares or other assets, are subject to a reduced level of economic substance requirements.

What information is included in the Notification?

The Notification will include the following information:

- the type of Relevant Activity conducted (if applicable);

- amount and type of income arising from the CIGA and if such income has been subject to tax outside of the UAE; and

- if the entity is tax resident outside of the UAE and if yes, where.

When must the Notification be completed and submitted?

There are still several Licensing Authorities which have yet to announce their respective notification deadlines.

What are the penalties for non-compliance?

An administrative fine of between AED 10,000- 50,000 shall be imposed on any UAE entity which undertakes any Relevant Activity and fails to meet the economic substance test, or fails to provide information in respect of the same, or provides inaccurate information to its Licensing Authority. Furthermore, an administrative fine of between AED 50,000-300,000 can be imposed for each subsequent year of non-compliance. Ultimately, Licensing Authorities may suspend, revoke or deny renewal of the commercial licence of any offending entity.

Are there any practical implications for Corporate Governance?

Aside from complying with additional economic substance reporting requirements going forward, the Regulations will most likely have a relatively limited impact on UAE-headquartered businesses and foreign companies that have genuine commercial operations, assets and management in the UAE.

However, for entities that undertake Relevant Activities in the UAE, but are managed remotely (particularly for branches), it would be prudent to review corporate governance structures and operating models, and make all necessary adjustments to the same so as to ensure compliance with the Regulations. Such adjustments might include changes to:

- how board meetings are conducted, ensuring that the quorum should be physically present for the meetings in the UAE;

- how board meetings are recorded, ensuring that board minutes are drafted and executed on a regular basis showing that meetings have occurred in the UAE;

- the number of full-time employees resident in the UAE;

- the amount of operational expenditure incurred in the UAE; and

- the level of physical assets in the UAE.