UAE VAT: Reverse Charge mechanism on sale of Electronic Devices in UAE

14 September 2023

The Ministry of Finance has announced the issuance of Cabinet Resolution 91 of 2023 regarding the Application of the Reverse charge mechanism on Electronic Devices among Registered businesses in UAE under UAE VAT.

The supply of Electronic Devices to a registered business for the purpose of resale or production/ manufacture of other Electronic Devices shall be subject to a reverse charge mechanism. The recipient will have to account for VAT on the value of such supplies. Electronic Devices are defined as mobile phones, smartphones, computers, tablets and their parts and components.

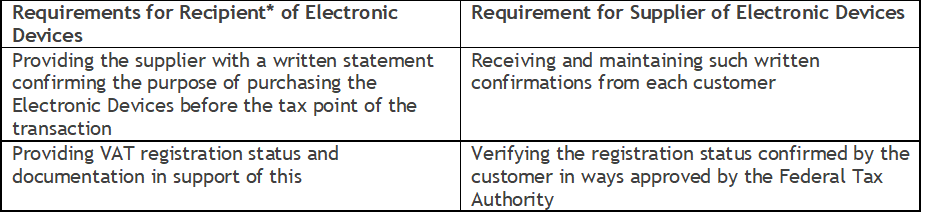

The Cabinet Resolution specifies certain conditions and documentation required to be maintained for both the supplier and the recipient:

* Only recipients who intend to resell the Electronic Devices or use the Electronic Devices for Production or manufacture of other Electronic Devices

The FTA has clarified that a Decision will be released to specify the standards to be followed while defining the parts and components of Electronic Devices.

The above Cabinet Resolution is applicable after 60 days from the date of publication in the Official Gazette.

BDO Insights

The announcement of a reverse charge mechanism on the supply of Electronic Devices will be a welcome move for the Electronic Devices businesses in UAE. Electronic Devices have been an attractive sector for both tourists and consumers in the UAE.

The UAE has previously implemented a similar mechanism for other key sectors like gold/ diamond trade and oil/gas trade between registered businesses. Given the value and volume of transactions undertaken, reverse charge mechanism will help Electronic Device traders to manage their cashflows on account of VAT more effectively. Further, reverse charge mechanism is a measure adopted by the Tax Authorities to reduce the risk of tax leakages, for instance, collection of VAT and non-payment to the government.

If you have any queries or need support evaluating the implications of the above update on your business, please contact one of our tax experts.